Business Insurance in and around Oklahoma City

One of Oklahoma City’s top choices for small business insurance.

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

Running a small business requires much from you. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, trades, specialized professions and more!

One of Oklahoma City’s top choices for small business insurance.

This small business insurance is not risky

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, business owners policies or commercial auto.

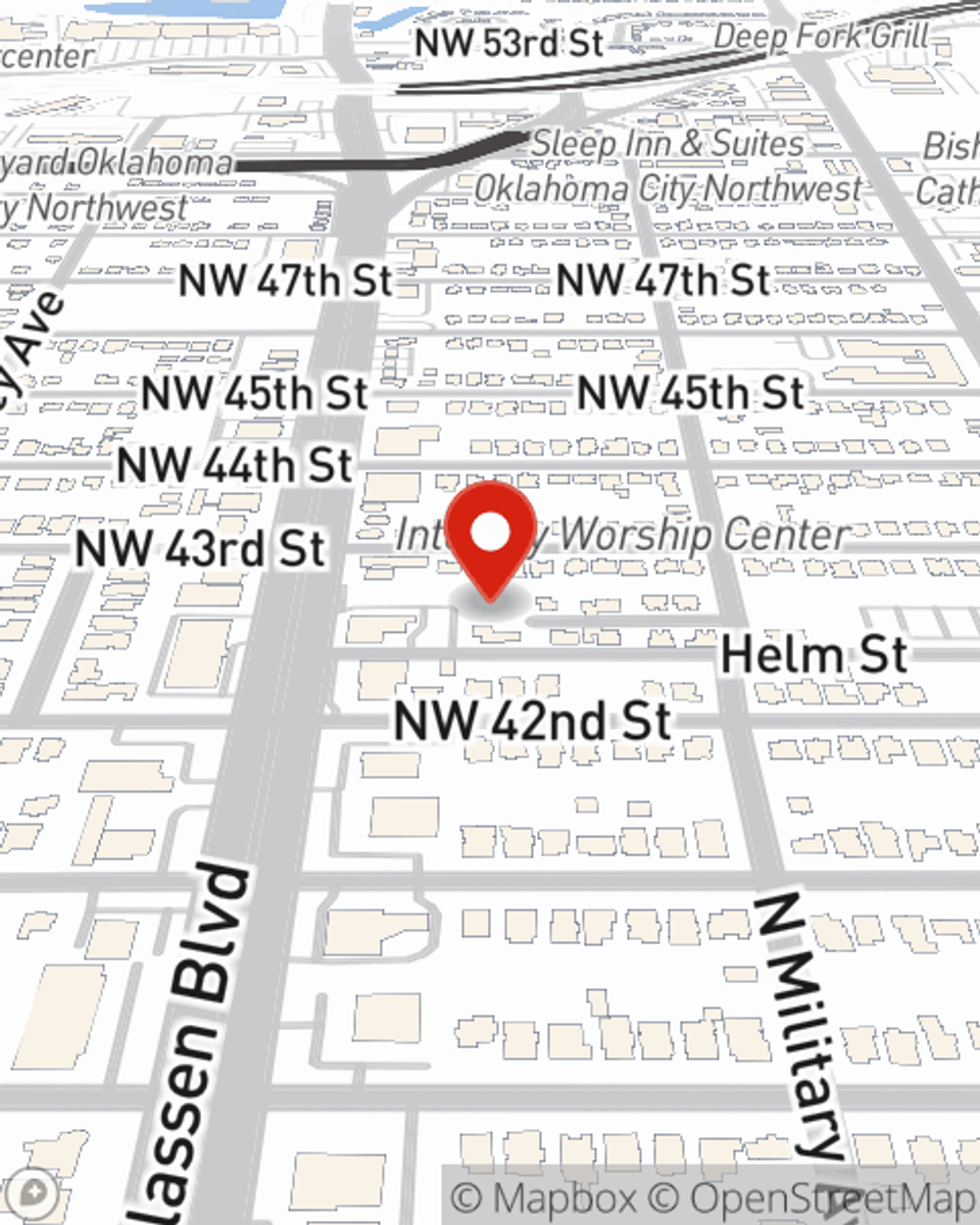

Since 1935, State Farm has helped small businesses manage risk. Visit agent Kenneth James's team to discover the options specifically available to you!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Kenneth James

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.